Author

Carbon Markets: An Efficient Policy to Mitigate Climate Change? A Reflection of Theory and Practice

Abstract

Carbon markets are seen by economists as one of the most efficient policies to fight climate change. This article reviews a short history of the global development of carbon markets and explains the economic theory behind it. Furthermore, it employs previous empirical research on the efficacy of carbon markets and discusses if the hypothesis on efficacy also holds in practice. The discussion leads to the result that carbon markets should not be seen as an alone-standing policy mitigating climate change. Rather, they should be implemented together in a set of different effective carbon policies.

Abbreviations

AAU Assigned Amount Unit

CDM Clean Development Mechanism

COP Conference of the Parties (Decision Making Body of UNFCCC)

CO2 Carbon Dioxide

ETS Emission Trading Scheme

EU European Union

GHG Greenhouse Gas

IPCC Intergovernmental Panel on Climate Change

JI Joint Implementation

KETS Korea Emission Trading Scheme

RGGI Regional Greenhouse Gas Initiative

UNFCCC United Nations Framework Convention on Climate Change

USA United States of America

WCI Western Climate Initiative

Chapter 1: Introduction

Climate change is one of the biggest challenges of our time. Unless action is taken to reduce the global greenhouse gas (GHG) emissions, the world will heat up further with devastating consequences (OECD 2016). The world will suffer from more intensive and frequent extreme weather events, droughts and flooding, and a global rise in the sea-level. This will directly affect natural ecosystems and thus also the human ecosystem. These climate-related risks depend on the magnitude and the rate of global warming with high confidence. The Intergovernmental Panel on Climate Change (IPCC) reported that human activities are estimated to have caused global warming of approximately 1.0°C by 2017 compared to pre-industrial levels [This degree of global warming is defined as the 30-year average compared to the average between 1850 and 1900 (IPCC 2018)]. If global warming continues to rise at the current rate, it is likely to reach 1.5°C between 2030 and 2052. Researchers state that an increase above 1.5 to 2.0°C will significantly increase the climate-related risks (IPCC 2018). Thus, policymakers of 195 countries agreed in the Conference on Climate Change COP21 in Paris to reduce global GHG emissions until 2050 such that the global warming to limited to 2.0°C – favorably to 1.5 °C – compared to pre-industrial levels (OECD 2016).

To reach the goals of the Paris Agreement, policymakers and economic researchers worldwide have discussed what the most efficient policy tools to reduce GHG emissions are. The pricing of carbon is seen as a low-cost tool to effectively and gradually reduce emissions. Carbon pricing includes taxes on carbon as well as the introduction of carbon markets – also called emission trading schemes (ETS) (OECD 2016). This article focuses on carbon pricing in the form of markets, discusses several carbon market features and their efficacy. The efficacy, defined as achieving significant GHG emission reductions, is examined in theory as well as through previously conducted empirical studies of established carbon markets.

The remainder of this article is structured as follows: Chapter 2 reviews the history of carbon markets and carbon markets that have been established until today briefly. Chapter 3 explains the theory of a carbon market as cap-and-trade system and its cost-efficacy compared to carbon taxes – the other policy option to introduce carbon pricing. Chapter 4 reviews empirical findings on established carbon markets, or ETS. Chapter 5 draws a conclusion.

Chapter 2: A Short History of Carbon Markets

Global carbon markets affect businesses in all divisions of the economy today and their growth is higher than never before. In 2019, carbon markets grew 34 % and had a total value of e194 billion, based on Refinitiv’s global assessment of traded volume and carbon prices. Major carbon market policies have been implemented in Europe (EU ETS), North America (WCI, RGGI, and an emerging market in Mexico), China (a regional pilot ETS and an emerging national ETS), South Korea (KETS), Japan, Australia, and New Zealand (Calel 2013, Refinitiv 2020). This chapter describes the rise of carbon markets in history briefly. Furthermore, it explains the key principles of the Kyoto Protocol.

The first idea of a system of tradable permits was proposed by Coase in 1960. Before, economic theory was offering only the option to levy a tax on polluting companies – the so-called Pigouvian tax. However, Coase criticized the “polluter pays” principle for not being efficient. A tax would not be the optimal policy since the policy maker cannot know the optimal tax level [The theory behind it is explained in Chapter 3]. Thus, Coase argued that, with a proper definition of property rights, the market mechanism would lead to “an optimum utilization of rights” (Coase 1960, Calel 2013). However, Coase did not explicitly suggest this market for pollution control policies yet. In 1966, Crocker proposed that this system of tradable permits would offer important advantages for pollution control since policymakers could learn from the price signal in the permit market if the regulation is effective (Crocker 1966, Calel 2013). Montgomery (1972) showed in a theoretical model that carbon markets are theoretically efficient in achieving desired GHG reduction targets (Montgomery 1972). During the 1970s and the 1980s, scientists increasingly warned about global warming caused by the emission of GHGs. However, a rise in the implementation of carbon markets took around two more decades. In 1992, the first United Nations Earth Summit took place in Rio de Janeiro and led to the establishment of the UNFCCC. However, the agreement was not able to make binding emission reduction targets due to strong fossil fuel interests in the USA and the EU (Calel 2013).

The first binding agreement on emission reductions was achieved in the Kyoto Protocol in 1997. Generally, the agreement placed a heavier burden on industrialized countries – the so-called Annex I parties – since they are largely responsible for past GHG emissions. Thus, the developing countries – the non-Annex I parties – did not need to meet binding mitigation targets. Table 1 shows the Kyoto Protocol’s emission reduction targets for Annex I-countries. Countries that had limited GHG emissions in 1990 and were experiencing an expansion phase in that time received positive targets (UNFCCC 2008, Chesney et al. 2013).

Table 1: Emission Reduction Targets of Annex I-countries in the Kyoto Protocol

(Source: UNFCCC 2008)

Country | Target (1990 – 2008/2012) |

| |

EU-15, Bulgaria, Czech Republic, Estonia, Latvia, Liechtenstein, Lithuania, Monaco, Romania, Slovakia, Slovenia, Switzerland | – 8 % |

US | – 7 % |

Canada, Hungary, Japan, Poland | – 6 % |

Croatia | – 5 % |

New Zealand, Russian Federation, Ukraine | 0 |

Norway | + 1 % |

Australia | + 8 % |

Iceland | + 10 % |

To realize the emission reduction targets, the parties decided on three mechanisms: (1) emission trading, (2) joint implementation (JI), and (3) the clean development mechanism (CDM). Each country got a number of assigned amount units (AAUs) – the permits to emit GHGs. For the emission trading mechanism, the parties decided that the rights to emit GHGs –the AAUs– can be traded between the Annex I-parties. The JI gives Annex I-parties the possibility to invest in emission reduction projects in other Annex I-countries whereas the CDM aims to support emission reduction projects in the non-Annex I-countries through e.g. afforestation or reforestation projects. The JI and the CDM can result in emission reduction credits for the countries (UNFCCC 2008).

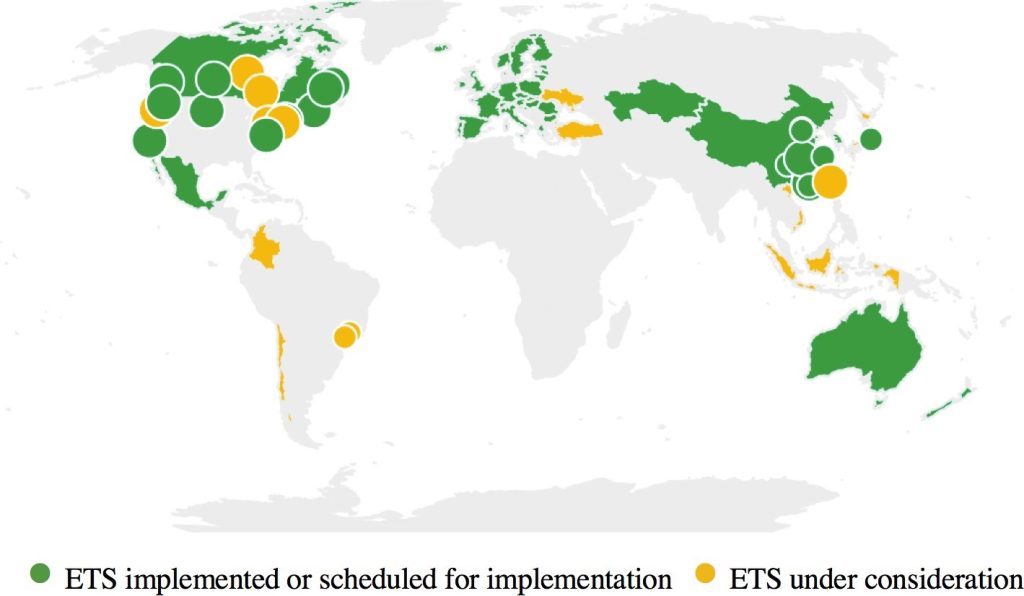

Although the Kyoto Protocol took until 2005 to set into force and experienced some back- lashes – e.g. with the USA’s official withdrawal from the protocol in 2001 – it can be seen as the major starting point for carbon market policies around the globe. After 2003, a series of regional carbon policies, including the RGGI, emerged in the USA. The EU launched its ETS in 2005 and New Zealand in 2008 (Calel 2013). Furthermore, the UNFCCC has agreed in 2015 on the Paris Agreement which binds all participating countries on their self-stated emission reduction targets that can also be fulfilled with the help of carbon market policies (OECD 2016). Today, 31 emission trading initiatives have been implemented or are scheduled for implementation. Figure 1 provides an overview of emission trading initiatives worldwide (World Bank 2020). The EU ETS is seen as the most important driver in the reduction of GHG emissions with almost 80% of the globally traded volume in emission allowances in 2019 (Refinitiv 2020). Also, the EU ETS is the most used carbon market in research about the efficacy of those policies. Before discussing research findings of the efficacy of carbon markets, the next chapter explains the system of carbon markets and the theory in more detail.

Figure 1: Summary Map of Regional, National, and Subnational Emission Trading Initiatives

(Source: World Bank 2020)

Chapter 3: The Tradable Permit System and Cap-and-trade

Coase’s approach to a market mechanism is based on the definition of property rights (Coase 1960). However, the environment – or the atmosphere in case of climate change – does not have an owner. In economic terms, this is called a public good. Public goods have the characteristic that they can be used, or polluted, by everybody without a cost, they are non-excludable. Thus, the atmosphere is a public good (Chesney et al. 2013). This leads to the over-consumption or pollution of the atmosphere and thus to climate change. Hence, climate change can in economic terms be described as a market failure since the property rights of the atmosphere are not properly defined (Perman et al. 2003). To correct this kind of market failure, the idea of carbon markets is to define property rights on the permit to emit a certain number of GHG emissions. For instance, an AAU defined in the Kyoto Protocol gives a country the permit to emit one metric ton of CO2 equivalent (Chesney et al. 2013).

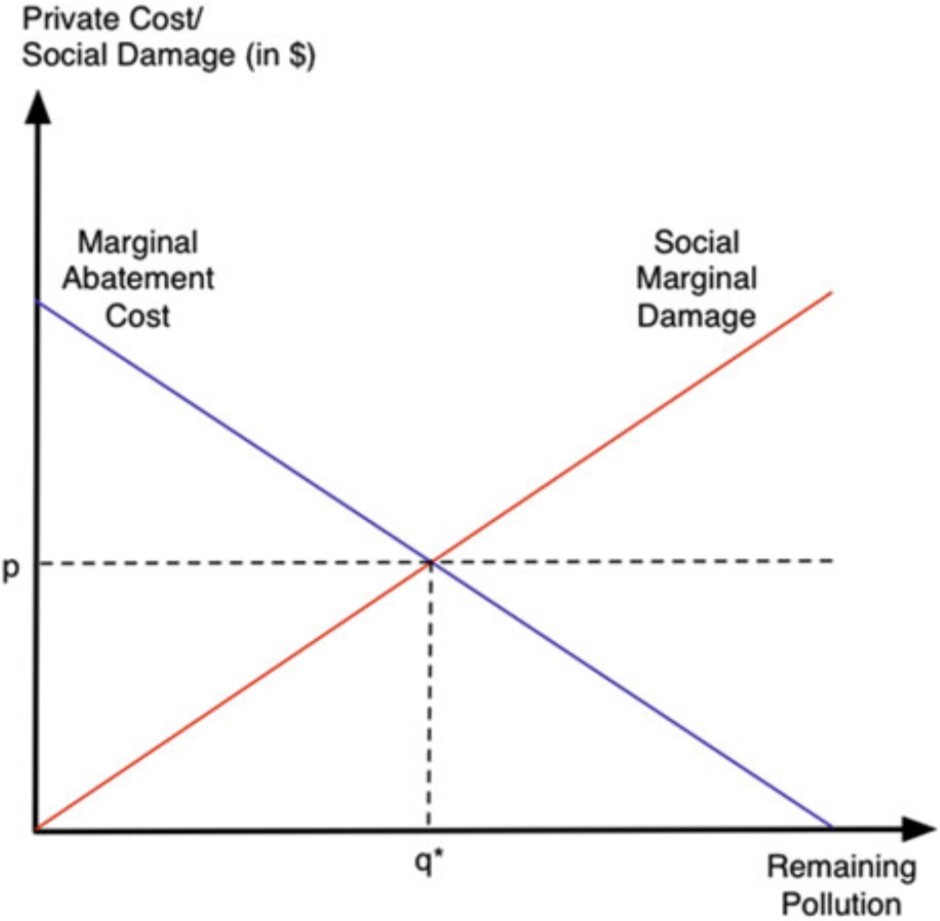

Theoretically, when property rights are defined and enforced, GHG emitting companies [For a better reading, this paper only names companies but means all kinds of GHG emitting organizations] could negotiate with the people that are affected by climate change and eventually come to an equilibrium level of GHG emissions. Figure 2 visualizes this negotiation process. q∗ depicts the optimal quantity of emissions or pollution resulting after the negotiation. Any emission quantity below q∗ would result in abatement costs for the GHG emitting companies that are too high to accept. Any quantity above q∗ results in a social damage that would not be acceptable for the people affected by climate change. The market sets a quantity q∗ of GHG at the optimal price p. If the policy maker would have the perfect information on the costs of polluting companies and affected society, then the policy maker could set a tax that is equal to p which would lead to the optimal quantity of emitted GHGs. Thus, the advantage of a carbon market to a Pigouvian tax is that the policy maker is not required to have perfect information (Coase 1960, Chesney et al. 2013).

Nonetheless, there are limitations to Coase’s theory of tradable permits. For instance, it has been morally criticized for holding against the “polluter pays” principle. If the polluting company owns all initial rights to emit GHGs, the society would need to buy abatement permits from the polluter which seems amoral. Furthermore, it can be questioned ethically to assume that all pollution of the atmosphere can be valued with money. However, the biggest limitation is that the side affected by pollution or the emission of GHGs is the society, defined as the sum of all households. It is practically impossible for every single household to negotiate with the polluting company and it is questionable if every single household is even able to estimate its individual damage by GHG emissions.

Figure 2: Equilibrium Level of GHG Emissions under Coase’s Theory

(Source: Chesney et al. 2013)

For these reasons, the carbon markets implemented today are cap-and-trade markets (Chesney et al. 2013). Cap-and-trade systems set a limit, or ceiling, on the aggregate GHG emissions of a group of emitting companies for a certain period of time by giving out a number of tradable emission permits to companies in the group. Each company in this system can emit as much as it decides, as long as it acquires the number of permits to do so. At the initial implementation of the system, the policy maker gives out an initial number of emission permits to each company, either for free or via auction (Stavins 2007).

Polluting companies are then able to trade emission permits in the same setting as in Coase’s market. When the permit price is lower than the marginal abatement cost of pollution for a company, then, it will abate and sell its permits with a profit to a company that has higher abatement costs. Thus, the companies with the highest abatement costs are able to emit GHGs whereas the companies with the lowest abatement costs, e.g. with better technologies, can sell their permits. This leads to an efficient permit price which is equivalent to the lowest possible marginal abatement cost since the company with the lowest marginal abatement cost would always sell its permits. Hence, cap-and-trade is the most cost-effective way for policymakers to achieve emission control [Montgomery (1972) has shown this in a theoretical model beyond the explanation here] and gives high flexibility to companies compared to other policies such as an emission tax. Further, this system can also lead to technological improvements since companies are encouraged to lower their abatement costs with technology improvements (Montgomery 1972, Perman et al. 2003). The next chapter reviews several empirical studies that have examined the efficiency of cap-and-trade carbon markets regarding the reduction of GHGs in practice.

Chapter 4: Review of Studies examining the Efficacy of Carbon Markets

Theoretically, carbon markets are efficient in emission reduction and cost-effective. However, is this also the case for the carbon markets that have been implemented practically? Which policy design features are important for an efficient carbon market? What are the learnings from approximately 20 years of carbon markets today? This chapter reviews empirical studies and findings of implemented carbon markets and discusses which features have been shown as efficient. The focus lies on the EU ETS because the majority of empirical studies have examined this carbon market.

A widely discussed design feature in carbon market research is the initial allocation of the emission permits. How should they be allocated, for free, auctioned, or a mix of both? And if they are allocated for free, on what should the initial quantity of the companies’ permits be based? The first implemented programs tended to provide permit allocations to the companies for free to prevent especially the heavy industries from profit losses since they had very high GHG emissions compared to other industries. Newer cap-and-trade programs or amendments of newer programs have changed towards auctioning allowances. This is because it has been shown, that the free allocation of emission permits overcompensates companies. Companies tend to treat free permits as opportunity costs which they pass-through to the customers (Goulder et al. 2010, Newell et al. 2014). This has especially been shown for the German electricity market where customers faced higher electricity prices (Sijm et al. 2008, Ellerman et al. 2010). Thus, researchers plead to allocate the most of emission permits via auctioning whereas some permits need to be allocated for free to retain profits for industries that cannot change as quickly to more carbon-efficient technologies (Goulder et al. 2010).

Anderson and DiMaria (2011) examined the EU ETS during its pilot phase between 2005 and 2007 and found that there has been a large over-allocations of allowances. This was because policymakers were afraid that companies could face large profit losses. However, the lessons learned from the pilot phase was that there was a clear move towards an increased auctioning.

Furthermore, the EU targeted a reduction in the overall cap in 2013 of 21 % below 2005 (Anderson and DiMaria 2011). Bel and Joseph (2015) examined the first phase of the EU ETS between 2005 and 2012 where still most of the emission permits were given out for free to the companies. Their study reveals that there has been significant emission abatement in the first phase. However, the biggest share of the reduction was due to the economic crisis (Bel and Joseph 2015). Petrick and Wagner (2014) examined the impact of the EU ETS on German manufacturing companies and found that companies participating in the EU ETS abated 20 % of their GHG emissions between 2007 and 2010 compared to non-participating companies. They stated that this abatement was largely achieved by the improvement of energy efficiency (Petrick and Wagner 2014). Also, Calel and Dechezleprêtre (2016) found in an empirical study that the EU ETS significantly contributed towards technological improvements.

These briefly summarized research results show that the experience is more complex than the theory. There are several different design features in carbon markets that affect emission abatement results. It goes beyond the scope of this article to discuss all design features in detail but it has been shown that e.g. the initial allocation of emission permits is an important factor of influence. Also, the general economic situation and external shocks from crises affect the overall GHG reduction. However, various theoretical and empirical examinations of carbon markets show that they are an efficient tool to achieve emission reduction targets.

Altogether, economists state that carbon markets are the most cost-effective policy to reduce GHG emissions. The emission permits within these systems should preferably be auctioned and the revenue governments gain from auctioning should be reinvested for innovation in energy efficiency and distributional impacts individuals face through carbon pricing. The overall emission cap should be tightened gradually. Further, parallel to the carbon market, a carbon tax should be implemented to reduce emissions resulting from housing and transport of individuals that are not covered by carbon markets (Newell et al. 2014, EAERE 2020).

Chapter 5: Conclusion

This article discussed carbon pricing policies that can and should be implemented by policymakers to reduce GHG emissions worldwide to mitigate climate change. Although the idea of defining property rights on pollution emission and the establishment of markets for pollution control originated in the late 1960s, it took until the mid-1990s until carbon markets were worldwide on the rise. This article has briefly explained the principles of the Kyoto protocol and named the carbon markets that were established globally until today. Furthermore, it has explained the theory of defining property rights for public goods and the cap-and-trade system. Then, the fourth chapter has reviewed research on the efficacy in achieving GHG reduction targets. As the experience has been shown, the efficacy of carbon market policies depends heavily on the design features within the market. A gradually tightening cap as well as the initial auctioning of emission permits is important for its efficacy. Further, economists suggest to establish a set of carbon pricing policies – a carbon market together with a carbon tax – to achieve meaningful reductions in GHG emissions.

References

Anderson, B. and DiMaria, C. (2011). Abatement and Allocation in the Pilot Phase of EU ETS. Environ Resource Econ, 48:83–103.

Bel, G. and Joseph, S. (2015). Emission Abatement: Untangling the Impacts of the EU ETS and the Economic Crisis. Energy Economics, 49:531–539.

Calel, R. (2013). Carbon Markets: A Historical Overview. WIREs Climate Change, 4(2):107– 119.

Calel, R. and Dechezleprêtre, A. (2016). Environmental Policy and Directed Technological Change: Evidence from the European Carbon Market. The Review of Economics and Statistics, 98(1):173–191.

Chesney, M., Gheyssens, J., Taschini, L., et al. (2013). Environmental Finance and Investments. Number 1. Springer.

Coase, R. H. (1960). The Problem of Social Cost. Law & Economics, III.

Crocker, T. D. (1966). The structuring of atmospheric pollution control systems. The economics of air pollution, 61:81–84.

EAERE (2020). Economists’ Statement on Carbon Pricing. European Association of Environ- mental and Resource Economics. URL: https://www.eaere.org/statement/, last accessed on December 6.

Ellerman, A. D., Convery, F. J., and De Perthuis, C. (2010). Pricing Carbon: the European Union Emissions Trading Scheme. Cambridge University Press.

Goulder, L. H., Hafstead, M. A., and Dworsky, M. (2010). Impacts of Alternative Emissions Allowance Allocation Methods under a Federal Cap-and-trade Program. Journal of Environ- mental Economics and Management, 60(3):161 – 181.

IPCC (2018). Summary for Policymakers. Global Warming of 1.5 ◦C. An IPCC Special Report on the impacts of global warming of 1.5 ◦C above pre-industrial levels and related global greenhouse gas emission pathways, in the context of strengthening the global response to the threat of climate change, sustainable development, and efforts to eradicate poverty, World Meteorological Organization, Geneva, Switzerland, 32 pp.

Montgomery, W. D. (1972). Markets in Licenses and Efficient Pollution Control Programs. Journal of economic theory, 5(3):395–418.

Newell, R. G., Pizer, W. A., and Raimi, D. (2014). Carbon Markets: Past, Present, and Future. Annual Review of Resource Economics, 6(1):191–215.

OECD (2016). Effective Carbon Rates: Pricing CO2 through Taxes and Emissions Trading Systems. OECD Publishing, Paris. URL: https://doi.org/10.1787/9789264260115-en, last accessed on November 23, 2020.

Perman, R., Ma, Y., McGilvray, J., and Common, M. (2003). Natural Resource and Environmen- tal Economics. Pearson Education.

Petrick, S. and Wagner, U. J. (2014). The Impact of Carbon Trading on Industry: Evidence from German Manufacturing Firms. Kiel Working Paper, Kiel Institute for the Worl Economy (IfW), (1912).

Pigou, A. (1918). A Special Levy to Discharge War Debt. The Economic Journal, 28:135–156.

Refinitiv (2020). Carbon Market Year in Review: Record High Value of Carbon Markets in 2019. URL: https://www.refinitiv.com/en/resources/special-report/global-carbon-market-report, last accessed on November 26, 2020.

Sijm, J., Hers, J., Lise, W., and Wetzelaer, B. (2008). The Impact of the EU ETS on Electricity Prices. Final Report to DG Environment of the European Commission. Technical report, Energy research Centre of the Netherlands ECN.

Stavins, R. N. (2007). A U.S. Cap-and-trade System to Address Global Climate Change. The Brookings Institution.

UNFCCC (2008). Kyoto Protocol Reference Manual on Accounting of Emissions and Assigned Amount. URL: https://unfccc.int/process-and-meetings/the-kyoto-protocol/what-is-the-kyoto- protocol/kyoto-protocol-targets-for-the-first-commitment-period, last accessed on November 26, 2020.

World Bank (2020). Carbon Pricing Dashboard. URL: https://carbonpricingdashboard.worldbank.org/, last accessed on December 1, 2020.